Will Points and Miles Travel Destroy Your Credit Score?

-

AFFILIATE DISCLOSURE:

Parks on Recreation is part of an affiliate sales network and receives compensation for sending traffic to partner sites such as MileValue.com and Bankrate.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. We appreciate it when you use our affiliate links as it supports our content at no cost to you!

EDITORIAL DISCLOSURE:

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Let’s bust this myth. 👊💥

There’s a lot of misinformation floating around when it comes to using credit card points for free travel.

Maybe you’ve heard something like:

“Opening credit cards will ruin your credit score!”

“You should NEVER open a credit card unless you’re in a life-or-death emergency!”

“If you apply for a card, your credit score plummets faster than your motivation to go to the gym after January 15th.”

Okay, let’s pump the brakes. While it’s true that RECKLESS credit card use can hurt your credit, responsibly opening and managing credit cards can actually help your score over time. Yep, you read that right—playing the points and miles game the right way can be good for your credit.

Time to break it down. ⤵️

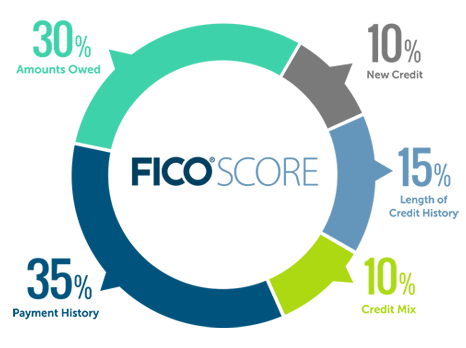

How Your Credit Score Is Actually Calculated

First, let’s talk about what actually goes into your credit score. It’s like baking a cake—there are multiple ingredients, and if you mess up one, it might not turn out great. Here’s what matters:

🔹 Payment History (35%) – Do you pay your bills on time? This is the BIGGEST factor. Set up autopay, and you’re golden.

🔹 Credit Utilization or Amounts Owed (30%) – How much of your available credit are you using? Keeping your balances low (under 10% of your total credit limit) is key.

🔹 Length of Credit History (15%) – The longer your credit history, the better. That’s why it’s smart to keep your oldest credit card open.

🔹 New Credit (10%) – Yes, applying for a new credit card causes a small, temporary dip in your score. But unless you're applying for 27 cards at once, it’s really not that big of a deal.

🔹 Credit Mix (10%) – Having a mix of credit types (credit cards, auto loans, mortgages) can help, but it’s not a major factor coming in at 10%.

Notice anything in particular about those first two pieces? 👀 Yep— Payment History and Credit Utilization counts toward a total of 65% of your credit score!! And you have the control over those parts each and every month.

By keeping that 65% looking stellar, the 10% ding from New Credit when you open your next card will have less of a blow.

Riding in style on Qatar Airways Business Class which we booked for 70k points!

So… Does Opening Credit Cards Hurt Your Score?

When you apply for a credit card, you get a hard inquiry on your credit report, which may lower your score by a few points temporarily. But as long as you:

✅ Pay your balances in full each month

✅ Keep your credit utilization low (ideally at or under 10% of your total credit)

✅ Space out applications by 90 days

…your credit score will recover and can even go up over time as your total available credit increases and your positive payment history builds. In fact, many people who responsibly use points and miles credit cards see their scores improve over the years!

FAQs: Credit Scores & Award Travel

Q: How much does my credit score drop when I open a new card?

A: Typically just a few points, and it bounces back quickly if you manage it well.

Q: How many credit cards is too many?

A: It depends! Some people will open one or two per year for points and miles travel, while others will open 6+ between personal and business cards while still maintaining excellent credit. The key 🔑 is responsible management.

Q: Will closing a credit card help my score?

A: Actually, no! Closing a card can hurt your credit by decreasing your total available credit and shortening your credit history. If a card has no annual fee, it’s usually best to keep it open or downgrade, if you can!

Q: What if I want to buy a house?

A: If you’re applying for a mortgage soon (like in the next 6-12 months), pause on new credit card applications. Otherwise, having a strong credit history with responsibly managed cards can actually help your mortgage approval odds.

How to Keep Your Credit Score Happy While Earning Points & Miles

Pay your statement in full and on-time every month. This is non-negotiable. Interest charges will wipe out any travel rewards you earn. Your “free travel” is no longer free if you’re paying for it via interest!

Keep your credit utilization low. When your statement closes, try to have no more than 10% of your credit limit on the card. If you have a $10,000 credit limit, don’t let the card close with more than $1,000 on the card.

Don’t apply for too many cards at once. Space out applications by at least 90 days to avoid too many hard inquiries at once.

Pro Tip: Our favorite (and free!) points and miles app— Travel Freely— will keep track of your “90 day countdown” for you automatically! You’ll get notified when you’re READY for your next card.

Check your credit score regularly. Many credit cards offer free FICO scores, and sites like Experian or CreditKarma can help you track changes.

Only open cards that align with your travel goals. Chase the dream, not the hype! There may be a cool welcome bonus on an Aer Lingus ☘️ card, but if you have no use for those points (or you’re still able to add flexible point cards to your wallet) then there’s no need to open that card.

Need new card ideas? ⤵️

Head to our Best Offers Page to check out our favorite cards — by using our click-through links (at no additional cost to you!), you’ll help support all our free content!

Certain credit cards— like the Capital One Venture X Rewards Credit Card— give you airport lounge access that could make your travel days that much more enjoyable!

👀 Bottom Line

So, does responsibly using credit cards for points and miles destroy your credit? Absolutely not. If anything, it can be an opportunity to boost your score while scoring free travel.

Now that you know the truth, the only thing left to do is decide where you’re going first. Mexico? Japan? A weekend in Vegas? The sky (literally) is the limit.

Want more tips on making points and miles work for you? Follow us on Instagram @parksonrec for bite-sized travel tricks, credit card tips, and vacation inspiration to keep you dreaming big!

👉 Head to our Best Credit Cards page to see the latest credit card welcome offers!

We thank you soooo much for supporting our content by using our links. At no additional cost to you, you’ll help support all our free content we provide just by using our click through links to apply! 🫶

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.